投資人專區

Investor Relations

News and Updates

Our company is listed on the Emerging Stock Market and discloses significant information on a non-regular basis through the Market Observation Post System (MOPS). Please visit the Taiwan Stock Exchange's Market Observation Post System and enter the stock code 7731 to access the latest major announcements and related information of our company.

Financial Information

Operating Revenue

Unit: NT$ million

| Month | 2025 | 2026 | Revenue Increase or Decrease Amount | YoY | Monthly Revenue Summary |

|---|---|---|---|---|---|

| 1 | 47.226 | 59.461 | 12.235 | 25.91% | - |

| 2 | 50.675 | - | - | - | - |

| 3 | 52.139 | - | - | - | - |

| 4 | 54.226 | - | - | - | - |

| 5 | 43.558 | - | - | - | - |

| 6 | 60.78 | - | - | - | - |

| 7 | 35.967 | - | - | - | - |

| 8 | 52.587 | - | - | - | - |

| 9 | 52.155 | - | - | - | - |

| 10 | 49.44 | - | - | - | - |

| 11 | 67.379 | - | - | - | - |

| 12 | 155.574 | - | - | - | - |

| Annual Total | 721.706 | 59.461 | -662.245 | -91.76% | - |

Investor Relations

Stock Code

7731Today's Stock Price

All stock quotation data on this webpage is provided for reference purposes only and should not be a basis for investment decisions. MARX Biotech is not responsible for any inaccuracies, delays in updates, or actions taken by readers in relation to the data. Any information on this webpage should not be reposted without permission.

Corporate Governance

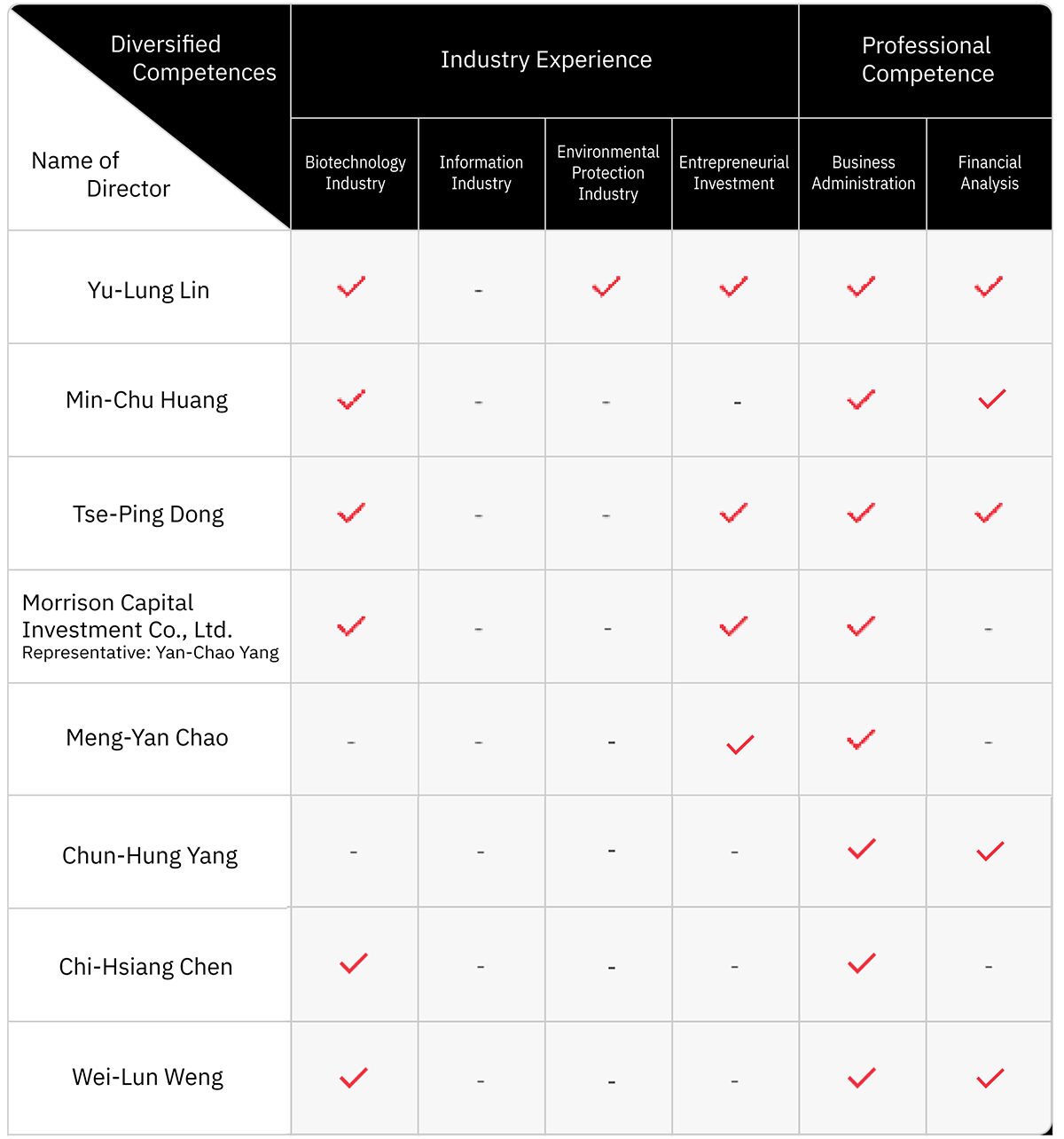

Board of Directors Diversity

To enhance corporate governance and foster the robust development of the Board of Directors' composition and structure, the company promotes and values a diverse board policy. This policy, in accordance with Article 20 of the "Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies", encompasses various factors such as gender, age, nationality, culture, as well as professional knowledge and skills including professional background, expertise, and industry experience. The Company is committed to upholding this diversity policy.

The Company's current Board of Directors' diversity policy is implemented as follows:

Independence of the Board of Directors

The Company's current Board of Directors consists of 9 members. There are no circumstances among the Directors that fall under the provisions of Article 26-3, Paragraphs 3 and 4 of the Securities and Exchange Act.

Members of the Board of Directors

Chairman

Yu-Lung Lin

Education

University of Southern California(USC), MBA

National Chengchi University, MBA

CFA, FRM, CPA

Experience

Supervisor , Deloitte & Touche Leader.

Supervisor of the OTC department, Taipei Exchange(TPEx).

Vice President of underwriting syndicate , SinoPac Securities.

Vice President, Vincera Capital.

Director & Vice President of underwriting syndicate, Fubon Securities Co.

Director & Executive Vice President, Fubon Securities Venture Capital Co.

Director

Morrison Capital Investment Co., Ltd.,

Representative / Yen-Chao YangEducation

Tunghai University, Bachelor of Landscape Architecture

Experience

PM, JiaXing Sanwa Yoshida Building Materials Co., LTD.

Chairman, Morrison Capital Investment Co., Ltd.

Chairman, MARX Biotech Co., Ltd.

General Manager & Deputy Spokesperson, MARX Biotech Co., Ltd.

Director

Tse-Ping Dong

Education

National Taiwan University, Ph.D.

Experience

Distinguished Professor of College of Management, National Taiwan Normal University(NTNU)

CEO, National Taiwan Normal University Center for Global Innovation and Entrepreneurship(NTNU CGIE)

Director

Min-Chu Huang

Education

Takushoku University, Tokyo,Japan, MBA

Experience

General Manager, Taipei Exchange(TPEx).

Chairman. SinoPac Securities.

President, Taiwan Securities Association.

National Chengchi University, Adjunct Professor of Department of Accounting (18 years).

National Taipei University, Adjunct Professor of Business Administration (5 years).

Director

Meng-Yan Chao

Education

Fu Jen Catholic University, BBA

Experience

Principal, FourYuan Capital Limited Partnership.

Principal, ChaoMengYuan Investment Co. Ltd.

Principal & General Manager, Phargoods+ Inc.

Independent Director

Chun-Hung Yang

Education

Xiamen University, Ph.D. in Economics

National Taipei University, Master of Business Administration

National Sun Yat-sen University, Bachelor of Business Administration

Experience

Senior Vice President of Financial Management Group, Fubon Financial Holding Co.,Ltd.

Director & Senior Vice President, Fubon Securities Co., Ltd.

Chairman, Fubon Futures Co., Ltd.

Director, Fubon Asset Management Co., Ltd.

Director, Taiwan Futures Exchange Corp.

Independent Director

Chi-Hsiang Chen

Education

University of Texas at Austin, Ph.D. in Microbiology

National Chengchi University, Master of Executive Master's Program in Technology Management, Graduate Institute of Business Administration

National Taiwan University, Master of Science in Agricultural Chemistry

Experience

Senior Vice President, Maxigen Biotech Inc.

General Manager, Taiwan Leader Biotech Corp.

Chairman, UBI Pharma Inc.

Independent Director

Wei-Lun Weng

Education

National Chengchi University, Bachelor of Laws

Judicial Special Examination (Judge Qualification), 2001

Attorney Examination (Lawyer Qualification), 2001

Experience

Prosecutor, Taiwan Taoyuan District Prosecutors Office.

Prosecutor, Taiwan Shihlin District Prosecutors Office.

Delegated Prosecutor, Agency Against Corruption (MOJ).

Audit Committee

The Audit Committee of the Company consists of all Independent Directors. It convenes meetings at least once every quarter and may hold additional meetings as necessary.

The powers and responsibilities of the Audit Committee are as follows:

- In accordance with Article 14-1 of the Securities and Exchange Act, companies are required to establish or amend internal control systems.

- Assessment of the Effectiveness of Internal Control Systems.

- Adoption or amendment, pursuant to Article 36-1 of the Securities and Exchange Act of handling procedures for financial or operational actions of material significance, such as acquisition or disposal of assets, derivatives trading, loaning of funds to others, and endorsements or guarantees for others.

- Matters concerning the personal interests of the Directors.

- Significant asset or derivative transactions.

- Significant capital loans, endorsements, or guarantees.

- The offering, issuance, or private placement of any equity-type securities.

- Appointment, termination, or compensation of Certified Public Accountants (CPAs).

- The appointment or discharge of a financial, accounting, or internal audit officer.

- Annual financial reports and second quarter financial reports signed by the Board of Director, Managers, and Accounting Manager and audited by CPA.

- Other significant matters as required by other Companies or regulatory authorities.

Remuneration Committee

The Compensation Committee consists of three members appointed by resolution of the Board of Directors, with a majority of its members required to be Independent Directors

The committee is required to hold at least two meetings per year and is responsible for fulfilling the following duties with due care and diligence, and submitting their recommendations to the Board of Directors for discussion:

- Regularly review this regulation and propose any amendment suggestions.

- Establish and regularly review performance evaluation standards, annual long-term performance goals and policies, systems, standards, and structures for the compensation for Directors, supervisors, and managers. The content of the performance evaluation standards shall be disclosed in the annual report.

- Regularly assess the performance goals achieved by the Directors, supervisors, and managers of the Company. Based on the evaluation results obtained from the performance evaluation criteria, determine the content and amount of their individual salary compensation. The annual report shall disclose the individual performance evaluation results of Directors, Supervisors, and Managers, as well as the correlation and reasonableness of their individual compensation packages in relation to the evaluation results, which shall also be reported at the shareholders' meeting.

Internal Audit

The Audit Department of the Company operates under the authority of the Board of Directors. Its primary purpose is to assist the Board of Directors and management by examining and evaluating deficiencies in the internal control system, as well as assessing the effectiveness and efficiency of operations. Additionally, it offers timely recommendations to management for enhancing the system and ensuring the ongoing and efficient implementation of the internal control system. This enables the optimal utilization of corporate resources, improves operational integration efficiency, and aids management in fulfilling their responsibilities. Additionally, it supports management in fulfilling their responsibilities and serves as a basis for reviewing and modifying the internal control system.

Articles of Incorporation

Rules of Procedure for Shareholders' Meetings

Rules of Procedure for Board of Directors Meetings

Procedures for Election of Directors

Audit Committee Organizational Charter

Remuneration Committee Organizational Charter

Regulations for Board Performance Evaluation

Code of Ethical Business Conduct

Procedures and Guidelines for Ethical Business Operations

Code of Ethical Conduct

Corporate Governance Best Practice Principles